— 17 min read

Introduction to Construction Accounting

Last Updated Nov 29, 2023

Construction companies have to make difficult choices among many financial alternatives, like tendering on one project over another, selecting financing for materials or equipment or setting a project's profit margin. On top of that, construction is a notoriously volatile industry with a high failure rate, slow time to payment and inconsistent cash flow.

Accurately tracking costs, revenues and other financial data creates a foundation for companies to grow and stay cash flow positive. Given the unique financial challenges that construction businesses face, well-developed accounting processes are essential for executives to allocate financial resources efficiently.

Contents

Table of contents

What makes construction accounting different

Construction business involves very different challenges than other kinds of production. Most of these challenges arise from the fact that construction is project-based, and each project involves unique problems and solutions.

As a result, construction companies often find it difficult to match the efficiency of companies that make the same products repeatedly in a controlled location.

| Typical manufacturer | Construction business | |

|---|---|---|

| Production method | Process-based. Production involves repeated processes with easily identifiable costs. | Project-based. Production requires different processes, materials and equipment with varying costs. |

| Location | Fixed location. Manufacturing or production happens in a single (or several) controlled locations. | Decentralized. Each project takes place in a new location with varying site conditions and unique challenges. |

| Vendors | Consistent. Long-lasting relationships with vendors ease negotiations and improve efficiency. | Inconsistent. Frequent use of different specialty contractors and suppliers affects efficiency and cash flow. |

| Contracts | No retainage. Payment arrives in full or with regular payments for the full contract amount. | Retainage. Some portion of payment may be withheld until project completion even when the contractor's work is finished. |

| Cash flow | Predictable. Regular production and short-term contracts lead to manageable cash flow cycles. | Irregular. Retainage, slow payments and high upfront costs lead to long, irregular cash flow cycles. |

While traditional manufacturers have the advantage of controlled environments and optimized production processes, construction companies must constantly adapt to each new project. Even somewhat repeatable projects require modifications due to site conditions and other factors.

Additionally, while a manufacturing company can produce and store items for later demand, a construction company can only begin production once a contract is signed and a project is underway.

Furthermore, construction companies frequently use specialty contractors to complete portions of a project, which can lead to additional administrative burden with contract negotiations, payment disputes and more. On top of that, construction contracts often include retainage – a portion of the payment that is withheld until the entire project is complete. That means a contractor's profit margin may be held back long after their portion of the work is complete.

All of these factors can lead to irregular cash flow cycles and difficult financial management for construction companies. As a result, accurate accounting and careful financial analysis is essential for construction businesses to stay sustainable and grow.

Job costing

Job costing is a form of project-based accounting that helps construction companies keep track of the expenses for a specific job or project.

Construction companies, like most other businesses, maintain a general ledger, which keeps track of the company's financial accounts. However, the typical broad categories – like accounts receivable, accounts payable, accrued payroll, advertising and others – are not sufficient for monitoring the costs associated with construction projects.

That's where job costing and the job cost ledger provide powerful tools for construction accounting. Each job has its costs and revenues recorded alongside a project budget. Job costing creates a powerful cycle where previous financial data leads to better financial decisions in the future.

Here's what the job costing cycle looks like in practice:

- During a project, accountants record all job-specific costs with codes that provide details about each expenditure.

- After a project, management stores the job ledger for future use.

- Before the next project, management analyzes past job ledgers to create more accurate estimates and tenders based on real-world costs.

This cycle continues throughout the life of the construction company, which gains a competitive advantage by using real-world job cost data to optimize tenders, estimates, profit margins and more.

Methods of accounting

Construction companies can choose among different accounting methods: cash, accrual, percentage of completion and completed contract. These four approaches differ in how they track income, expenses and profit.

Each method of accounting has advantages and disadvantages. Keep in mind that certain methods are unavailable to large companies with high annual revenues.

| Accounting method | Description | Considerations |

|---|---|---|

| Cash | Revenues are recognized when payment is received, and expenses are recognized when bills are paid. | Financial statements with cash accounting are delayed and do not enable proactive decision-making. |

| Accrual | Revenues are recognized when bills are sent, and expenses are recognized when bills are received. | Taxes may be paid on income that is owed but not yet received. |

| Percentage of completion | Revenues and expenses are calculated based on the percentage of the project that is completed. | Completion percentage is calculated by dividing current costs by estimated costs. |

| Completed contract | Revenues and expenses are recognized when a project's contract is completed. | Can lead to irregular cash flow cycles with long contracts. |

Understanding each type of construction accounting – as well as the advantages and disadvantages of each – can help a construction business choose the right method for its situation.

Cash method

Cash accounting is the simplest and most straightforward approach to tracking finances, but it's also the most limiting.

With the cash method, a company recognizes revenues when it receives payment and recognizes expenses when it pays bills. Calculating profit is simple, since profit is just cash received minus cash disbursed.

Advantages

One advantage of cash accounting is that companies can easily defer income tax in two ways:

- Paying next year's bills early: By paying bills that are due early in the next year during the current year, a company can artificially reduce its profit and consequently its tax liability.

- Briefly delaying incoming payments: By asking customers to send end-of-year payments at the beginning of the following calendar year, a company can artificially reduce its revenue and therefore its tax liability.

Even with this advantage, the cash method is typically only viable for very small construction businesses.

Disadvantages

There's a significant disadvantage to using cash accounting: Financial statements cannot be used for proactive planning. Because income and expenses are only recognized once money has already been received and sent, finances cannot be actively managed but are instead simply observed.

By the time a company using cash accounting recognizes a cash flow problem, it's often too late to do anything about it. That's why most construction businesses use more sophisticated accounting methods that enable more active financial management practices.

Accrual method

The accrual method offers a more forward-looking view of a company's finances by recognizing revenues and expenses as soon as bills are sent and received. For example, a construction company that has sent a bill for payment will record it as revenue even though the payment itself has not yet been received. Similarly, when the business receives a bill from a vendor or supplier, it will be recorded as an expense even if payment hasn't yet been sent.

Notably, construction companies whose contracts include retainage typically do not recognize that revenue until a project is fully completed – which is usually when they first have the right to receive that payment.

Advantages

Because the accrual method recognizes income and expenses before they actually occur, it enables construction financial managers to make decisions based on financial statements that project future cash flow. That way, management can see problems before they occur and make adjustments as necessary – like securing short-term financing or re-evaluating upcoming projects.

Disadvantages

One potential downside of the accrual method is that businesses can pay income tax on unrealized profit since the accounting system can record revenues that have not yet been received. One way to mitigate this problem is to structure contracts with the profit evenly distributed rather than front-loaded.

Percentage of completion method

The percentage of completion method is a type of accrual accounting, but it recognizes revenues, expenses and profit based on how much work is already finished on a project. This accounting method is particularly useful for large construction businesses and companies with long-term contracts.

To determine how much of a project is complete, simply divide the costs to date by the estimated cost at completion. For example, if $15,000 has been spent on a project that is estimated to cost $100,000 total, the project is 15 percent complete ($15,000 / $100,000 = 0.15).

Since 15 percent of the expected costs have been incurred, the company will also recognize 15 percent of the expected revenue and expected profit on its books.

Advantages

The percentage of completion method has numerous advantages for companies that are balancing several long-term projects. Most importantly, this method enables financial managers to get a clear view of the current financial status of each project as well as the financial horizon as each project progresses.

Construction businesses that have annual revenues exceeding $25 million over the last three years are required to use the percentage of completion method. These larger businesses also include general overhead costs within each project, which has the advantage of providing clear insight into exactly how profitable each job is.

Disadvantages

One potential downside of the percentage of completion method is that businesses may incidentally underpay or overpay for taxes depending on how accurately they estimate costs. Companies that underpay taxes must pay interest to the IRS on the amount underpaid, while companies that overpay will receive a return with interest – which is usually not as valuable as having cash on hand.

Completed contract method

The completed contract method defers recognition of income and expenses until a contract is fully completed. Construction companies may choose to use the completed contract method if they have a high volume of short-term contracts. As each contract ends, the expenses and revenues will be known, eliminating some of the uncertainty and estimating associated with the percentage of completion method.

Advantages

The completed contract method is helpful in eliminating the uncertainty associated with a project's costs and revenues. By the time a contract is completed, all costs are known, so the accounting presents an accurate picture of a company's financial state.

Disadvantages

However, the completed contract method has notable downsides.

Most importantly, a company can deal with large swings in income as contracts are completed, leading to potential difficulties managing cash flow – especially compared to the more regular cadence that comes with a percentage of completion.

This is especially true with a company that uses mostly long-term contracts, which are generally more compatible with the percentage of completion method.

Accounting & construction contracts

Construction contracts vary from project to project, and the type of contract a business uses will affect its accounting system. There are five main types of contracts used in construction:

- Lump sum contracts: A fixed price is set for the entire project or phase.

- Time and materials (T&M) contracts: Contractors are paid for material costs and labour with a built-in profit margin.

- Unit price contracts: Work is subdivided into repeatable fixed-cost units, with each unit billed separately.

- Guaranteed maximum price (GMP) contracts: An upper limit is set for the project, with the GC reimbursing for costs and paying out of pocket for cost overruns.

- Cost-plus contracts: Contractors bill for project costs and receive a predetermined profit percentage.

Many construction companies will repeatedly use the same type of contract for similar projects, and over time these businesses grow in their ability to monitor job costs, revenues and profit.

However, each contract type – in combination with the company's chosen accounting method – will affect the business's finances and accounting system. For example, time and materials contracts require sophisticated cost tracking to file for reimbursement. Further, T&M projects may have an uncertain scope, making it difficult to predict the estimated profit for any given project.

Understanding each contract type and knowing which projects call for a certain type of contract will help construction businesses keep track of their costs and revenue more accurately.

Retainage

Many construction contracts include retainage – also called retention – which is a percentage of the payment withheld for a specific period of time, often until the entire project is completed. While the percentage varies among contracts, retainage is often 5 to 15 percent of the total payment owed to contractors or 5 - 10 percent for public works projects in Canada.

The purpose of retainage is to ensure that owners have some assurance that contractors complete the entire job rather than abandoning work after progress payments are made. However, retainage can lead to significant cash flow challenges for contractors, who may lack the working capital necessary to take on new jobs if earned income is withheld.

Laws regarding retainage vary by province, but contractors in provinces that allow – or even require – retainage have to ensure that they can effectively grow their businesses while waiting months or years for retained payments.

Whether you are the one withholding retainage or it is withheld from your payments, accounting for retainage requires an addition to the chart of accounts. Retainage doesn't belong in accounts receivable or payable, because it is not collectible (or payable) until the contract conditions have been met for its release.

Instead, retainage is tracked in separate accounts on the general ledger, typically called retention receivable and retention payable. Once the retained funds are due to be released, the amounts are transferred to accounts receivable or payable.

Even when they are not collectible within the "current" timeframe of 12 months, retainage accounts are typically shown as current accounts and current liabilities, respectively. As a result, the financial statements of construction companies often include a paragraph describing the special treatment of retention.

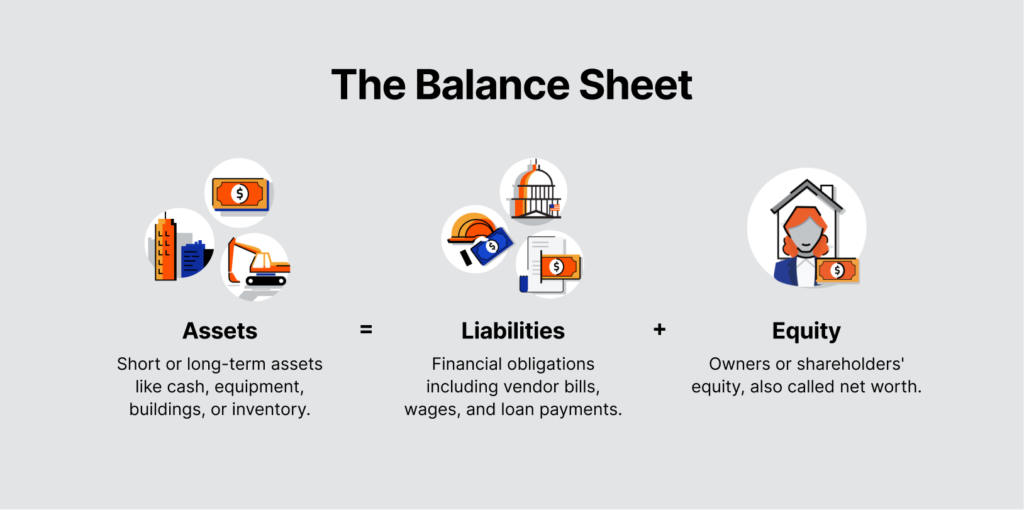

Balance sheets

A balance sheet is an overview of a company's finances, including assets, liabilities and equity. A monthly balance sheet is crucial for a construction business to keep track of its financial health, and a balance sheet produced at the end of the fiscal year provides a compelling look at year-over-year growth.

Each section of the balance sheet – assets, liabilities and equity – provides a different view into the company's finances. However, all three sections are related, as total assets are equivalent to the sum of liabilities and equity.

Assets

Assets are a company's financial resources – in other words, anything that is cash or could likely be converted to cash.

Examples of assets include cash, accounts receivable (AR), inventory and due from construction loans.

Liabilities

Liabilities are a company's financial obligations, which include both short-term and long-term debt.

Examples of liabilities include accounts payable (AP), capital lease payable, accrued payables and notes payable.

Equity

Equity, also referred to as net worth, is made up of the assets left over after liabilities are paid. This equity may be held by the owner or shareholders depending on the business structure.

For example, corporations will have their equity broken down into investments, retained earnings and net income. On the other hand, sole proprietorships and partnerships simply list the capital belonging to the owner – or to multiple owners.

Income statements

The income statement (or profit and loss statement) provides a breakdown of the revenues, costs and profit during a specific period of time – often monthly, quarterly and annually.

Revenues

Construction businesses record their revenues based on the accounting method that they use. For example, a company using the accrual method will note revenues based on billed payments even if they have not actually received payment.

Costs

Costs including materials, labour, equipment and subcontracts are listed on the income statement. These costs include both direct costs (which are easily assigned to a specific aspect of a project) and indirect costs (which are necessary for a project but are not easily tied to a specific component).

Equipment used for a single job will simply be listed under construction costs. However, equipment that is used across multiple jobs has its own category that tracks all related expenses – like lease payments, depreciation, fuel costs, maintenance and repairs – in order to accurately spread those costs across projects.

Overhead costs, which are essential for operation but not tied to a specific project, are listed on a separate area of the income sheet. These costs include items like insurance, rent, marketing and benefits. Properly managing and allocating overhead expenses is crucial for contractors, as it directly impacts the company's profitability and long-term financial stability.

Profit

On an income statement, profit is calculated in several ways: gross profit, net profit, profit before taxes and profit after taxes.

- Gross profit is equal to revenues minus costs.

- Net profit is equal to gross profit minus overhead.

- Profit after taxes is equal to net profit minus income taxes.

Importantly, the income sheet's view of profit must match the change in equity reflected on the balance sheet.

Accounting ratios

Accounting ratios are calculations that a construction business can use to get an overview of its financial health. There are dozens of accounting ratios that look into various aspects of a company's finances. Below are several of the most common accounting ratios, including the current ratio, quick ratio, debt-to-equity ratio and working capital turnover.

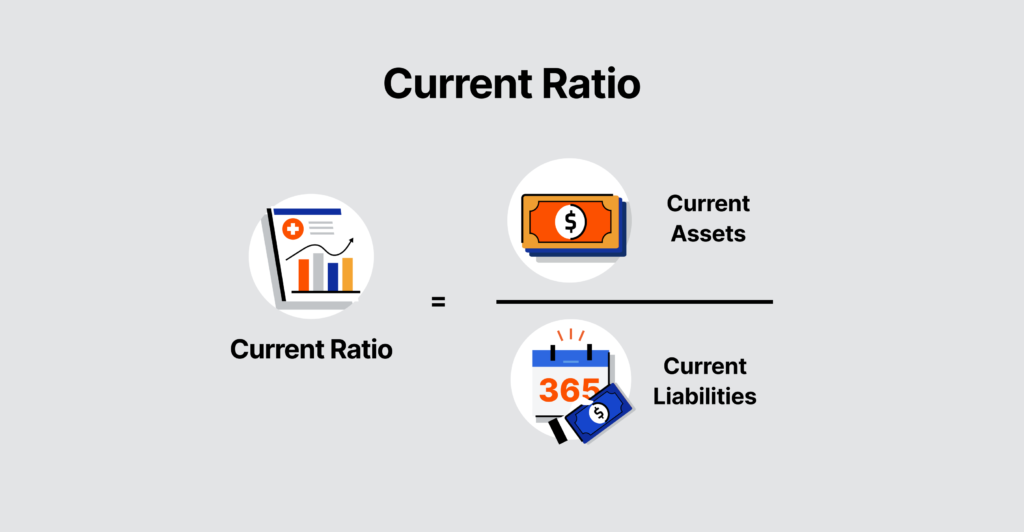

Current ratio

The current ratio evaluates how readily a company can use its current assets to cover its current liabilities. To calculate the current ratio, simply divide current assets by current liabilities.

Companies aim to have a current ratio above 1, which indicates that they have enough revenue to pay for their debts. Current ratios below 1 will likely need debt or equity financing to pay their liabilities.

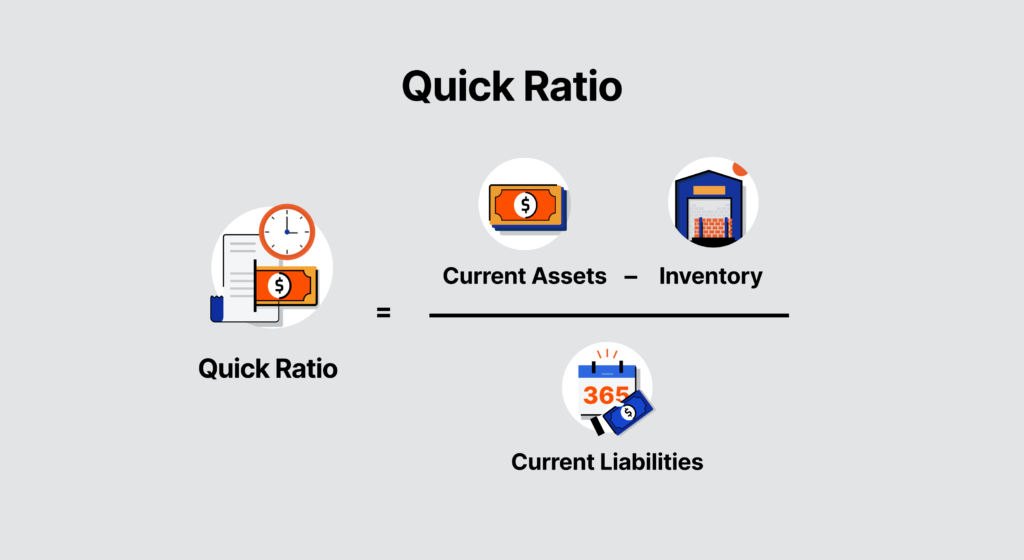

Quick ratio

The quick ratio measures whether a company can pay its current liabilities with cash or assets that can quickly be converted to cash. To calculate the quick ratio, simply add cash and accounts receivable and divide that sum by current liabilities.

A business with a quick ratio above 1 is regarded as liquid, meaning that it has enough cash resources to pay its current liabilities. Conversely, a business with a quick ratio below 1 does not have enough cash resources, so it will need to get an influx of cash through financing or by selling other long-term assets.

Notably, a business does not want to have a quick ratio that is too high, which indicates an excess of cash that could be more prudently invested.

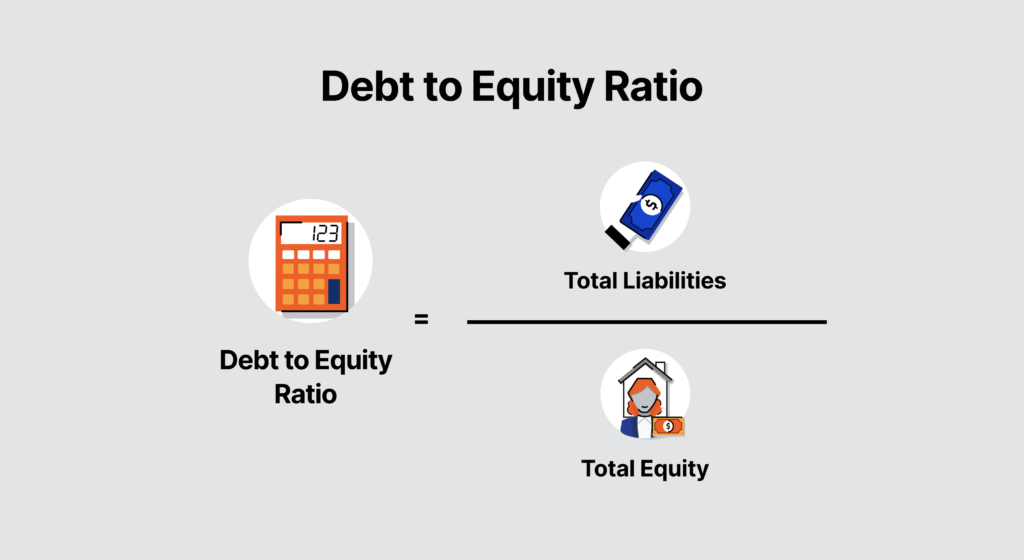

Debt to equity ratio

The debt-to-equity ratio evaluates the risk of a business's creditors and owners. To calculate the debt-to-equity ratio, divide total liabilities by net worth.

Ideal debt-to-equity for most companies is between 1 and 2, and companies with a debt-to-equity ratio higher than 2 may be unable to pay off its debts. On the other hand, a company with a debt-to-equity ratio of less than 1 may not be using enough debt financing to take on new projects and grow.

Working capital turnover

Working capital turnover measures how much revenue each dollar of working capital is producing. To calculate working capital turnover, first calculate working capital, which equals current assets minus current liabilities. Then, determine the turnover by dividing revenues by working capital. General contractors need to subtract subcontractor payments from revenues to calculate working capital turnover, as this money simply passes through the GC from the owner.

In general, a higher working capital turnover ratio is better. A higher number indicates that each dollar of working capital spent is leading to more revenue generated in sales. Across the construction industry, average working capital turnover ranges from 5 to 15 depending on specialization.

Notably, a very high working capital turnover ratio could indicate that the business is undercapitalized, meaning that it will not have enough capital to support its own growth from high sales volume.

Controlling costs with construction accounting

The most effective construction companies are proactive rather than reactive. By choosing an accounting system that accurately tracks past job costs as well as upcoming expenses and revenues, construction business owners can make more informed decisions when tendering, estimating and growing their companies.

Categories:

Tags:

Written by

Harshil Gupta

27 articles

Harshil is a Product Marketing Manager at Procore with a focus on General Contractors. Backed by a stint in engineering and rich experience in growth and product marketing, he's enthusiastic about the role of technology in elevating and enabling other industries. He lives in Toronto.

View profileBrittney Abell

9 articles

Brittney Abell joined Procore after 6 years as an accounting manager for a commercial general contractor, overseeing accounts payable and receivable. Before that, she worked as a contract administrator for an architecture & design firm for 6 years. She has worked on a variety of building projects, including travel stops, restaurants, hotels, and retail warehouses raging from $2M to $20M. She lives in Louisville, Kentucky

View profileDaniel Gray

27 articles

Daniel is an educator and writer with a speciality in construction. He has been writing construction content for Procore since 2022, and previously served as a Procore Content Manager before continuing to pursue an education career as an Assistant Headmaster for Valor Education in Austin. Daniel's experience writing for construction — as well as several clients under an agency — has broadened his knowledge and expertise across multiple subjects.

View profileExplore more helpful resources

The 5 Key Types of Construction Contracts

There are five common types of construction contracts: lump sum (or fixed price), time and materials (T&M), unit price, guaranteed maximum price (GMP) and cost-plus. Each of these contract types...

Guide to Guaranteed Maximum Price (GMP) Contracts in Construction

How GMP contracts work A GMP contract is a contractual agreement between a contractor and project owner that sets a maximum cost for the construction work of a project. In...

The Construction Tendering & Bidding Process Explained

Mastering the tendering process is essential for general contractors and subcontractors alike. Across the industry, a hit ratio of around 5:1 is generally considered successful — meaning that for every...

Tendering 101: Types of Tender in Construction

Owners and contractors alike rely on the tendering process to find the right partners for thriving, profitable projects. However, exactly how a project owner or general contractor chooses to manage...